HTX Trading Bot

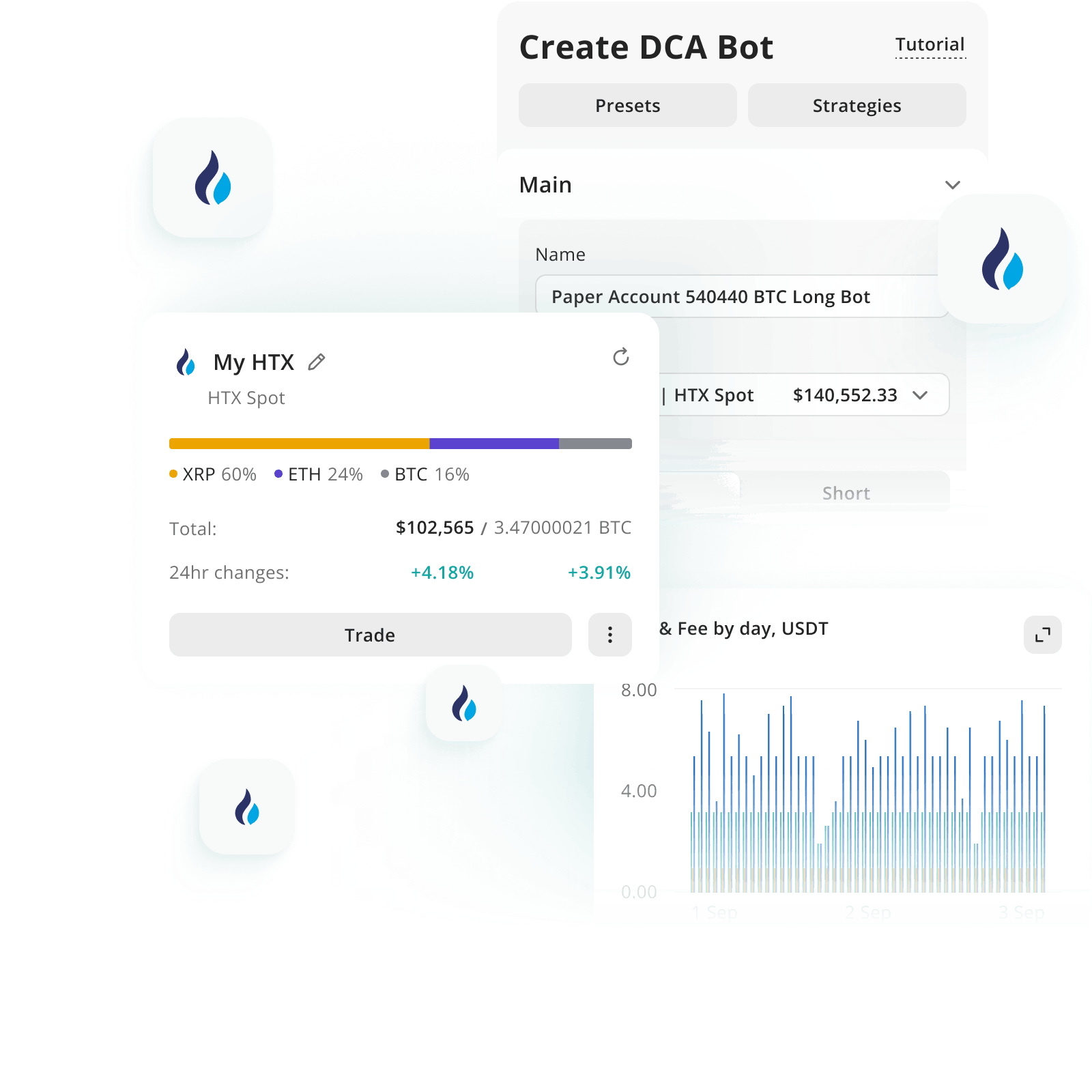

3Commas integrates with HTX, bringing automation, Smart Trades, and backtesting into one easy-to-use platform. Instead of managing trades manually, you can automate strategies, explore market opportunities, and track results with clarity across spot and futures markets.

Choose your HTX Trading Strategy

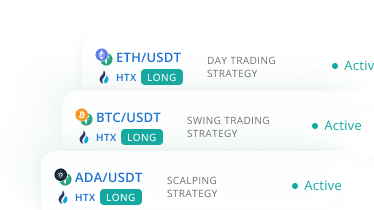

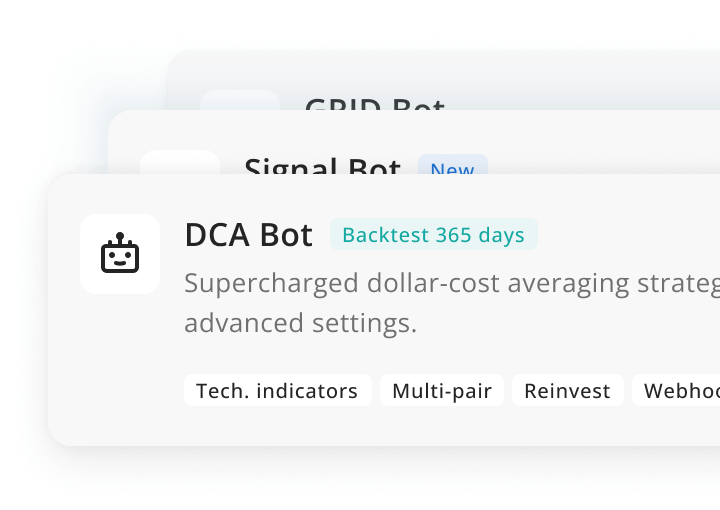

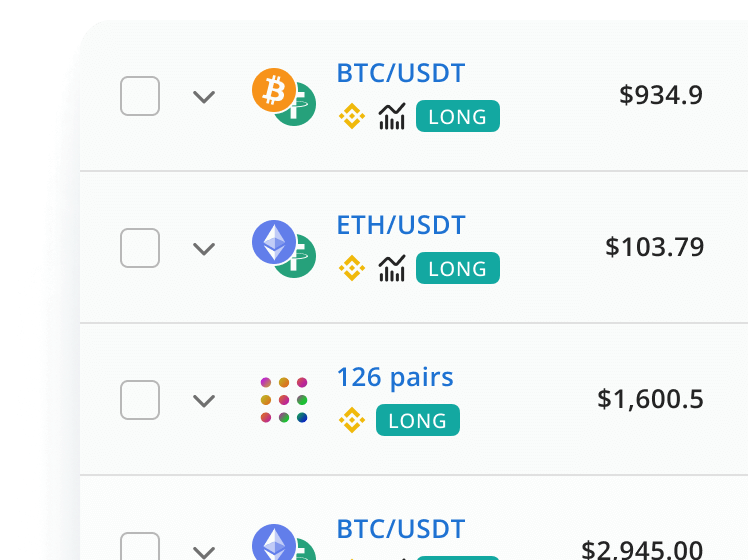

Automate your HTX trading with DCA, Grid, or Signal bots, or use Smart Trades for manual setups. Backtesting helps you test ideas on past data before trading live.

DCA bots on HTX spread purchases across different price levels, helping reduce volatility impact and making entries more consistent.

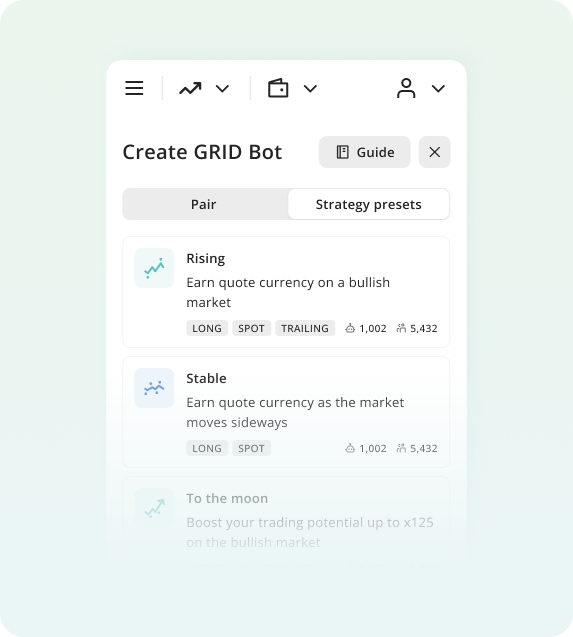

Grid bots on HTX place buy and sell orders in ranges, capturing opportunities in sideways or choppy markets automatically.

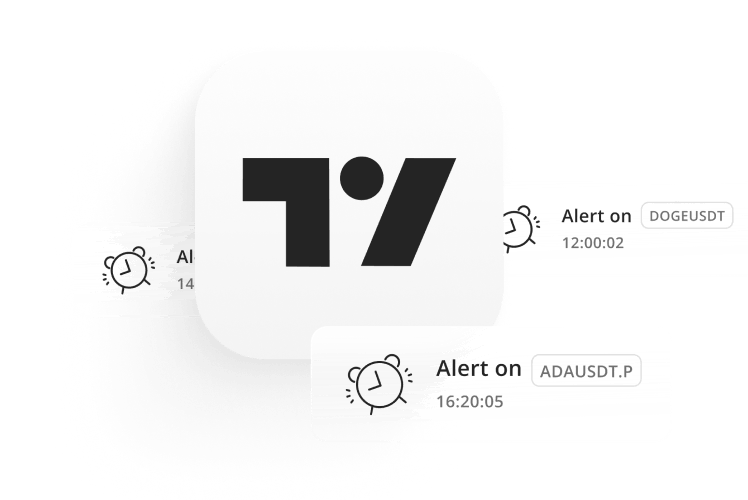

Connect TradingView signals to HTX bots to trigger trades instantly, removing the need for constant manual execution.

Set entries, targets, stop-loss, and trailing orders on HTX in advance, so you stay in control without watching charts all day.

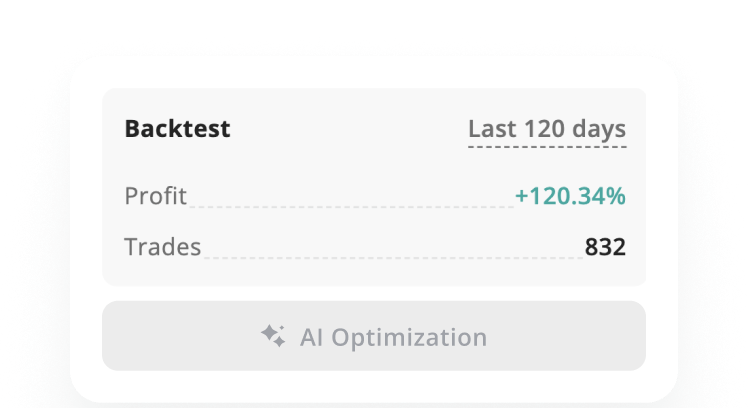

Simulate HTX strategies with historical data to refine setups and adjust risk before trading live.

What are the advantages of a 3Commas HTX Trading Bot?

3Commas helps automate trading on HTX with bots, backtesting, and Smart Trades. Strategies run day and night, while the clear interface keeps your results and adjustments simple.

- BEGINNER FRIENDLY

Manual & Bot Trades

Switch smoothly between manual trading and automation on HTX anytime.

- BEGINNER FRIENDLY

Backtesting & AI

Test HTX strategies on past data and refine them with optimization tools.

- BEGINNER FRIENDLY

Clear Interface

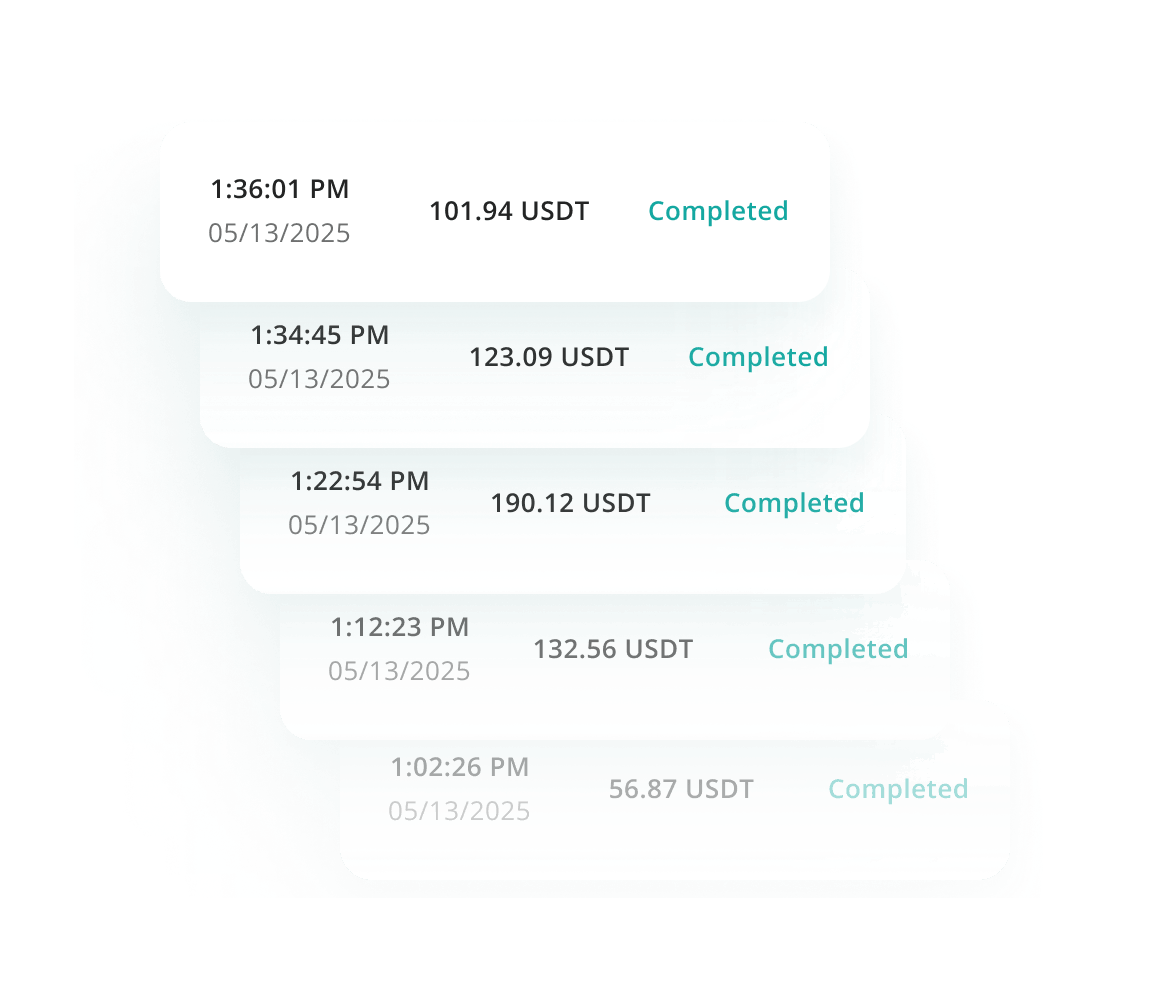

Track PnL, trades, and strategies in one HTX dashboard.

How to use the 3Commas trading bot on HTX?

2. Build, backtest, and refine your strategy.

Create your automated trading bot, test it on real market history, and let it trade your account with confidence.

3. Let your HTX Bots work hard for your success

Go live and let 3Commas automate your strategy with precision — so you can focus on growing your portfolio.

Stay on track — let your HTX bots handle the routine work.

Pick a PlanHTX Fees Explained

HTX charges maker and taker fees on trades. Fees are competitive and can be lowered by increasing your trading volume or holding HT tokens.

- 1

Spot Trading Fees Maker 0.20% / Taker 0.20%

- 2

Futures Trading Fees Maker 0.02% / Taker 0.04%

- 3

HT Discount Use HT tokens to reduce trading fees

- 4

Other Costs Deposit is free; withdrawal fees depend on the cryptocurrency

Safely connect 3Commas to HTX and 14+ leading exchanges

Connect your exchange accounts via the official Fast Connect integration or manually using the API keys

Secure by Design. Reliable. Transparent.

Secure Practices

We proactively fortify our security measures to meet evolving threats

Your Funds Solely Accessible By You

3commas does not have access to your funds

Transparent Ecosystem for All Trades

Our software is compliant with stringent regulations so you can put your mind at ease

Why do elite traders choose 3Commas?

Rated

Great

on

1,479 reviews

Jaak Humenson

Backtesting in 3Commas just makes life easier. I can try out ideas, see what works, and avoid dumb mistakes — all without losing any money. I bought Expert plan to make more backtests.

Colton Gabi

For a long time I used a strategy that I considered profitable, but over the long term I was slowly losing money. With the help of 3Commas backtesting feature I realized that I just needed to make small changes in strategy to become profitable trader.

Mick Gallacher

I've been with 3Commas for a couple of years now and it's got some very powerful bots which once you understand the mechanics of how they work you can really generate good returns for little risk

Why aren't you trading yet?

Let our technology take care of the tedious tasks while you focus on innovating new strategies

FAQ

Does 3Commas support HTX bots?

Yes, 3Commas integrates fully with HTX. You can run automated bots, Smart Trades, and backtesting to simplify and improve your trading strategies.

How do I connect HTX to 3Commas?

Generate API keys in your HTX account and add them to 3Commas. The secure link enables bots, manual trades, and portfolio tracking.

Can I backtest HTX strategies?

Yes, backtesting lets you test strategies on HTX using historical market data. This way you can refine entries, exits, and risk before going live.

Which strategies work best on HTX?

On HTX, traders often use DCA, Grid, and signal-based bots. The best choice depends on market conditions and your preferred risk profile.